Coopcerto App

App Redesign

Data analysis

Analytics tagging

Research

Project Details

Main Goal

Redesign and rebuild a legacy benefits card app into a scalable, compliant, and user-centered product, improving usability and user satisfaction in a regulated financial environment.

Challenges

-Strict regulatory and audit requirements -Legacy screens completely outside any design standard -No prior componentization — required aligning tokens, JSON structures, and components -A design system still evolving, with frequent theme swaps -Despite these constraints, the team delivered consistently without major rework.

Deliverables

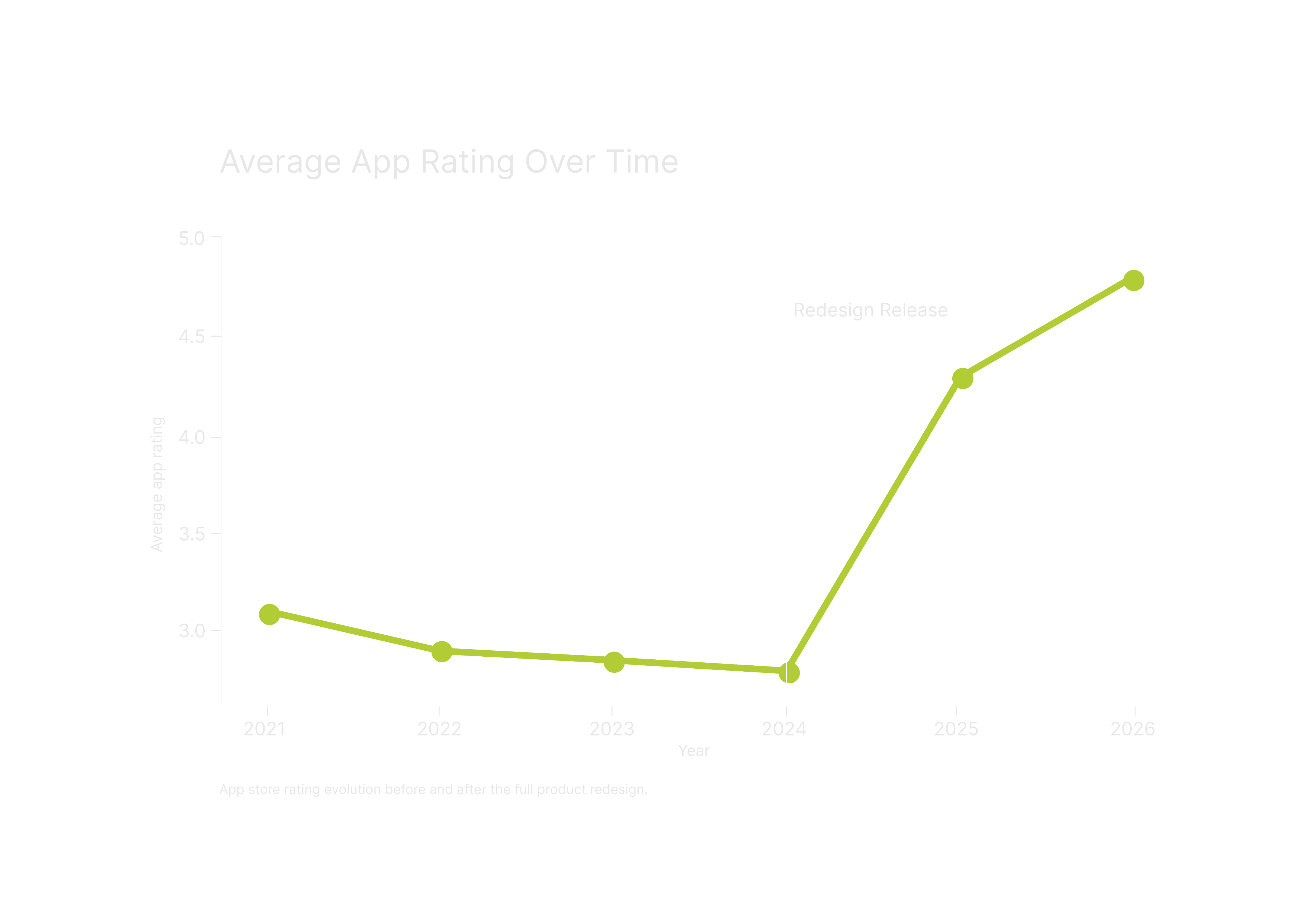

-Sole designer leading end-to-end redesign of a B2B2C fintech app -Rebuilt the product from legacy, non-scalable UI to a standardized system -Introduced key features expected in modern benefits apps -App rating increased from ~2.8 → 4.5+ -Strong growth in 5★ reviews and reduction in negative feedback

Context

Coopcerto is a prepaid benefits card used by companies to offer employee benefits.

The product operates in a highly regulated financial environment and serves both business clients and end users.

When I joined, the app available in the stores:

Was visually outdated

Had inconsistent UX patterns

Was not componentized

Had low user ratings and frequent complaints

At the same time, the product was preparing for:

The introduction of a new card network

Design system updates

Ongoing audits and regulatory reviews

Problem

From both user feedback and internal analysis, the main issues were:

Low app store rating (~2.8)

Fragmented experience and confusing flows

High number of usability-related support tickets

Missing core features (location, clearer statements, notifications)

No scalable design foundation for future growth

My Role

I was the only Product Designer on the project, working with a cross-functional squad:

2 Front-end Engineers

2 Back-end Engineers

1 QA

1 Product Owner

I owned the process end to end:

Discovery and analysis

UX and UI design

Prototyping and validation

Stakeholder alignment

Analytics tagging (Firebase)

Design handoff and documentation

Process

Discovery & Research

Because of regulatory constraints, discovery relied heavily on:

Reviewing extensive internal documentation

Understanding compliance and audit requirements

Stakeholder interviews across teams

In parallel, I conducted a deep competitive benchmark of benefits card apps to identify:

Industry UX patterns

Security and authentication standards

Best practices for card management and statements

Location-based discovery features

I also participated in the early stages of research related to the onboarding of a new card network.

Collaboration & Validation

Frequent design reviews with stakeholders

Close daily collaboration with engineering

Multiple internal feedback loops

Usability testing after high-fidelity delivery

Solution

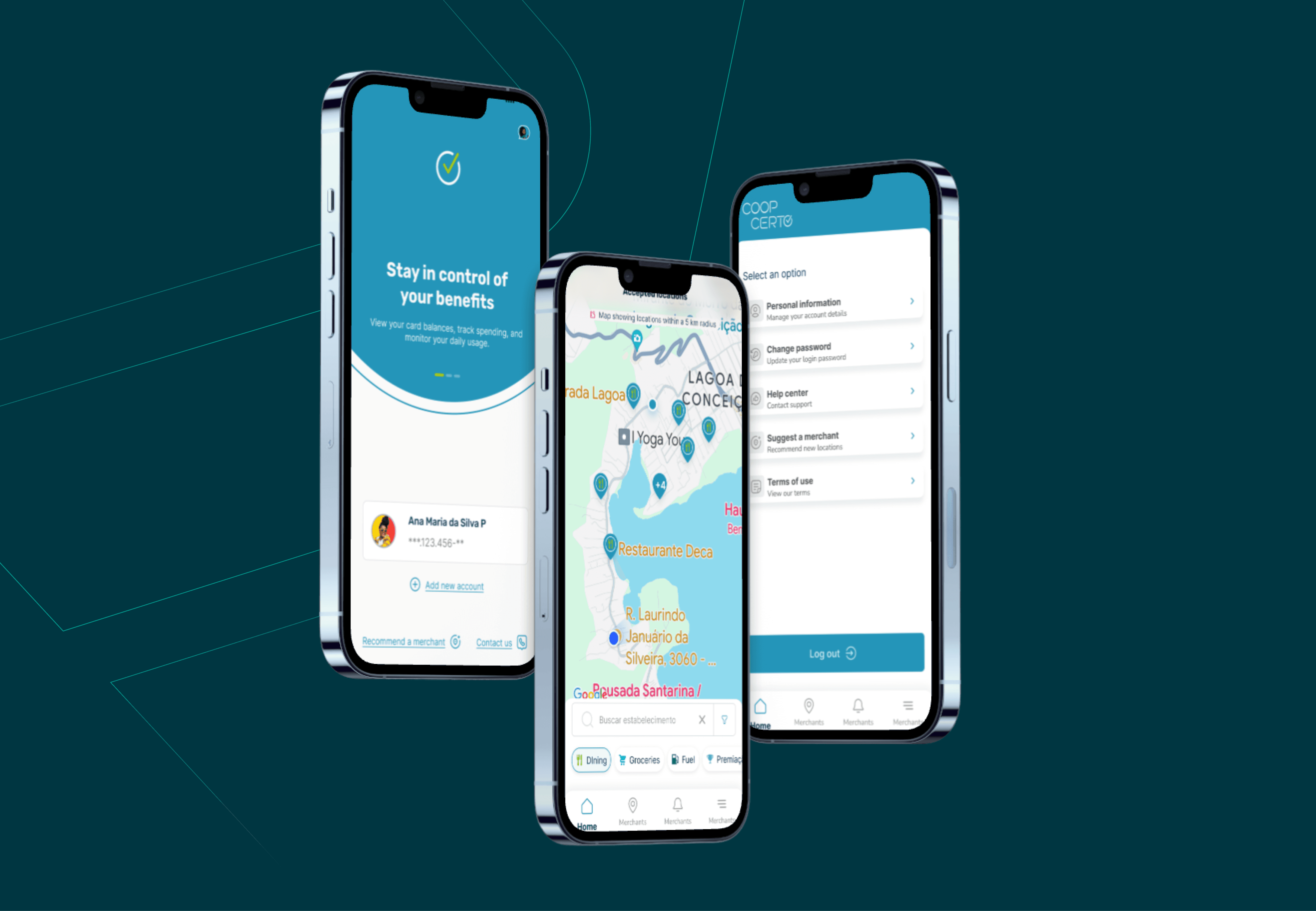

Full redesign using Coopcerto’s Design System (Acland)

Scalable and standardized flows and components

Navigable high-fidelity prototype

Analytics events mapped for Firebase

Updated institutional website

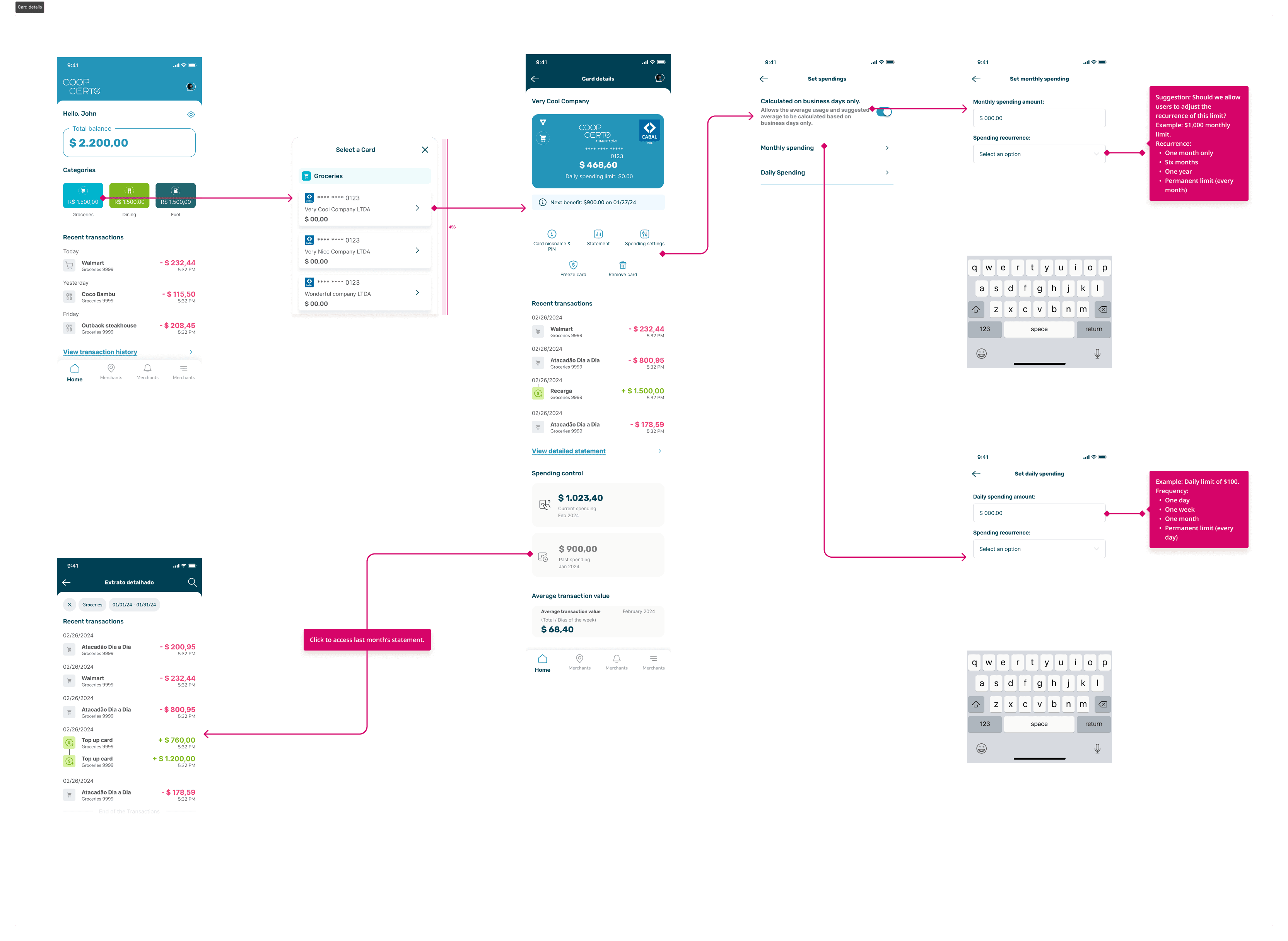

Key features

Nearby establishments map with filters

Redesigned authentication flow

Card details, statements, and transaction history

Balance and payment issue notifications

Integration of Sicoob’s virtual assistant

Results & Impact

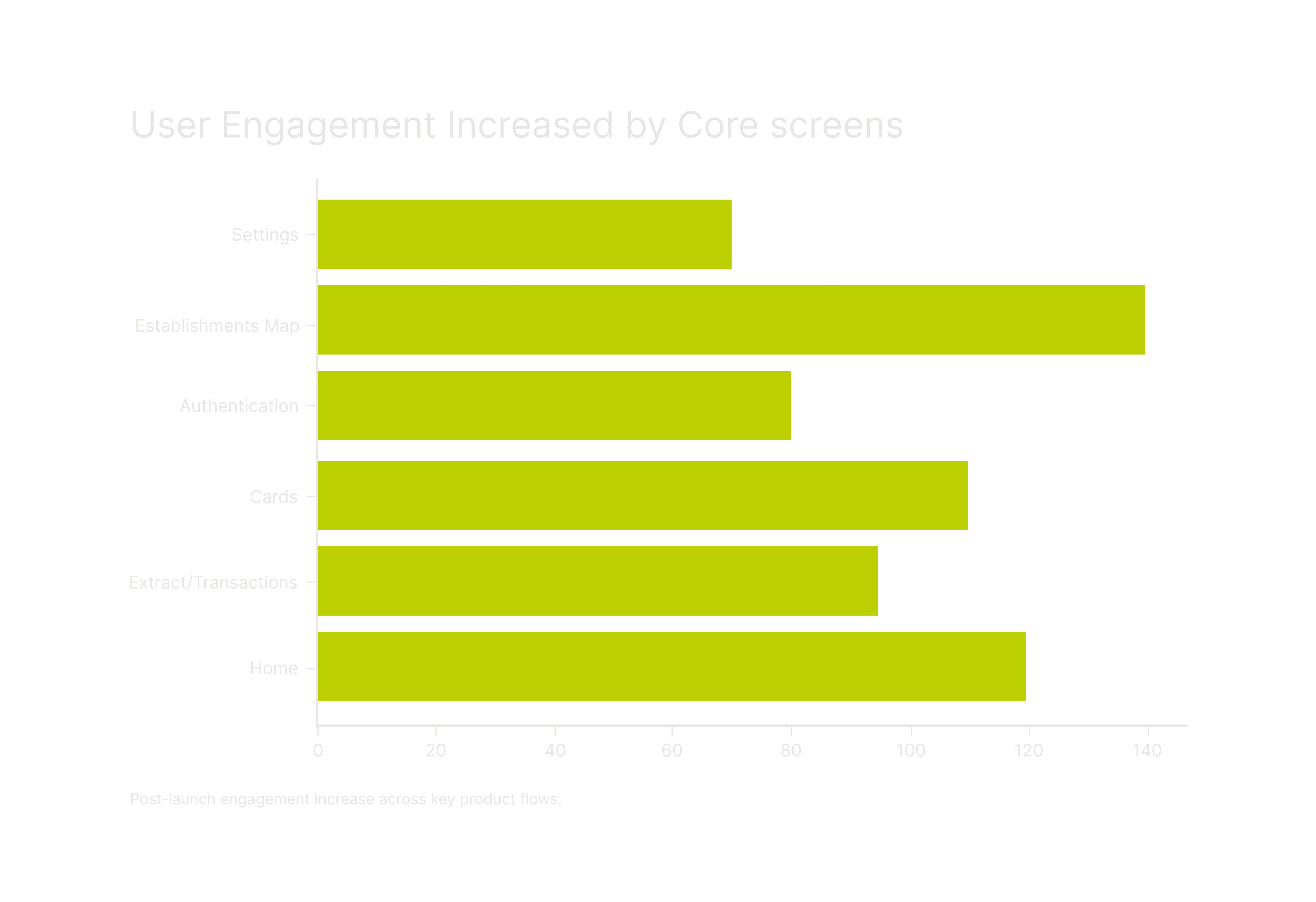

Due to the B2B2C nature of the product, traditional conversion metrics were not the primary success signal.

Instead, user perception and feedback were the strongest indicators:

App rating increased from ~2.8 to 4.5+

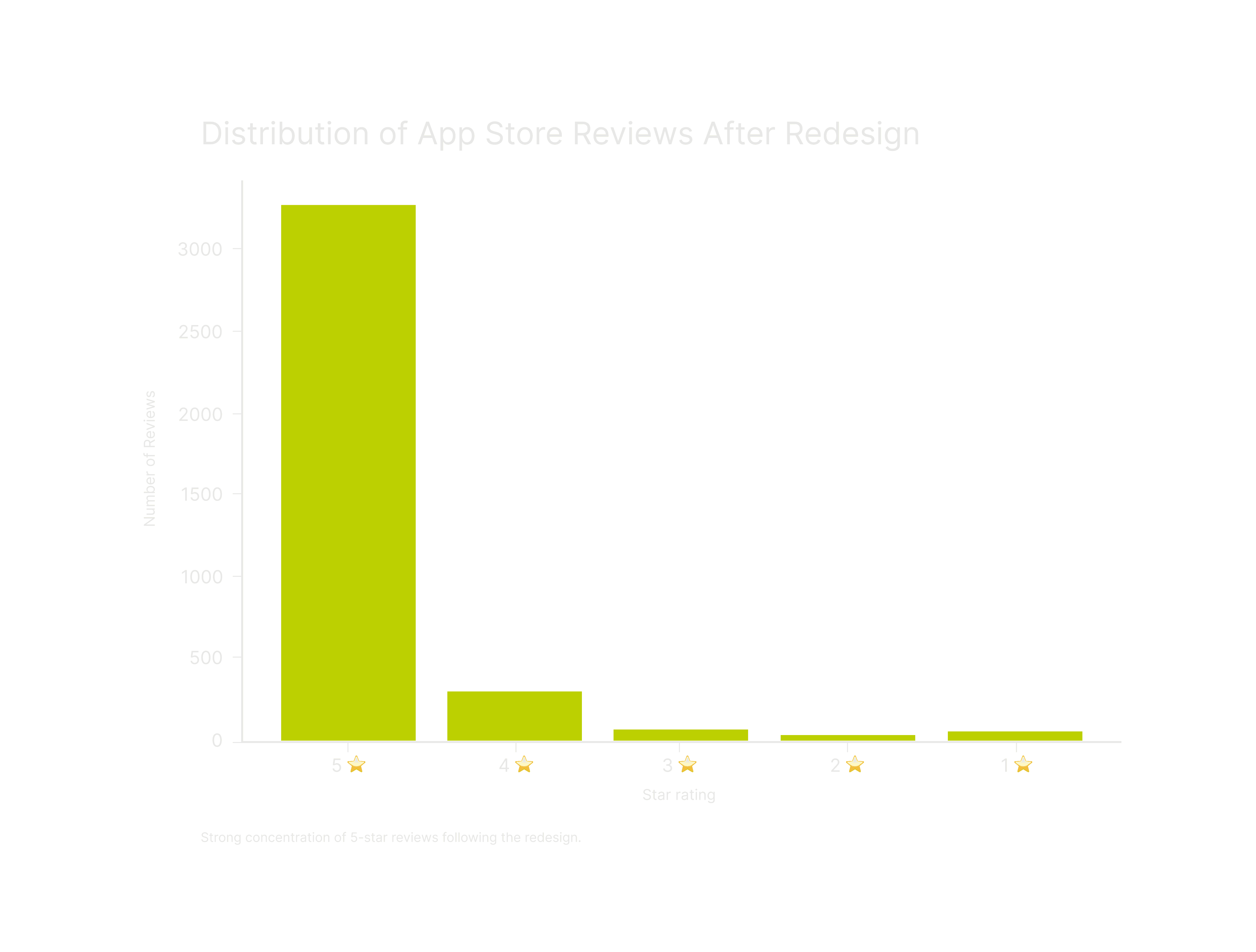

Large increase in total reviews, with a strong concentration of 5★ ratings

Clear drop in negative reviews and complaints

Reduction in usability-related support tickets

Improved task completion across core flows

These results reflect a significant improvement in usability, trust, and perceived product quality.

Results

Learnings

- Designing financial products requires deep domain understanding - Scalability matters even more in regulated environments - Strong documentation reduces long-term product and engineering friction - User satisfaction is often the clearest signal of UX success

App rating increased from 2.8 to 4.5

Strong growth in 5★ reviews

Reduction in negative feedback and support tickets

Improved task completion across core flows

Cool Data

Highlight in numbers:

🤘🏻 Team of 7

⏳ 1 year

🛠️ 13 Flows

💎 +1.7-point increase in app rating (2.8 → 4.5)